Our Local Experts

edited by Sabina Dana Plasse

photos by Ray Gadd

The Sun Valley real estate market has experienced a significant change in the past few years as many people have decided to make the Wood River Valley their home, moving from various cities and towns across the nation. Sun Valley has become a favorite among many families and others, offering a charming, world-class lifestyle at a number-one-rated ski resort (by SKI Magazine) while enjoying arts and culture that rival the best in the nation.

For the 2023 Sun Valley Real Estate Roundtable, top Sun Valley agents gathered to discuss the pros and cons of the current market and where inventory in specific sectors is limited while other areas are booming. Building and remodeling are at an all-time high, even though available land is scarce. Cash deals are still firm while potential buyers wait in the wings, and sellers still demand a specific value for property.

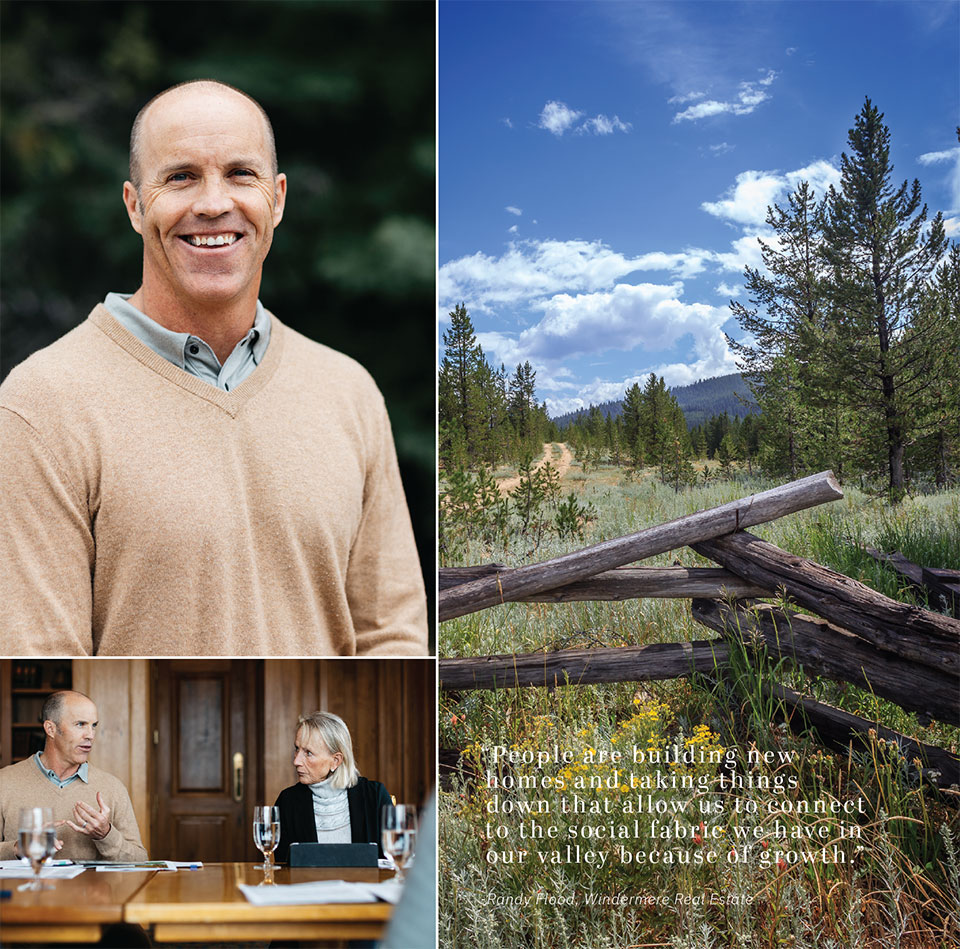

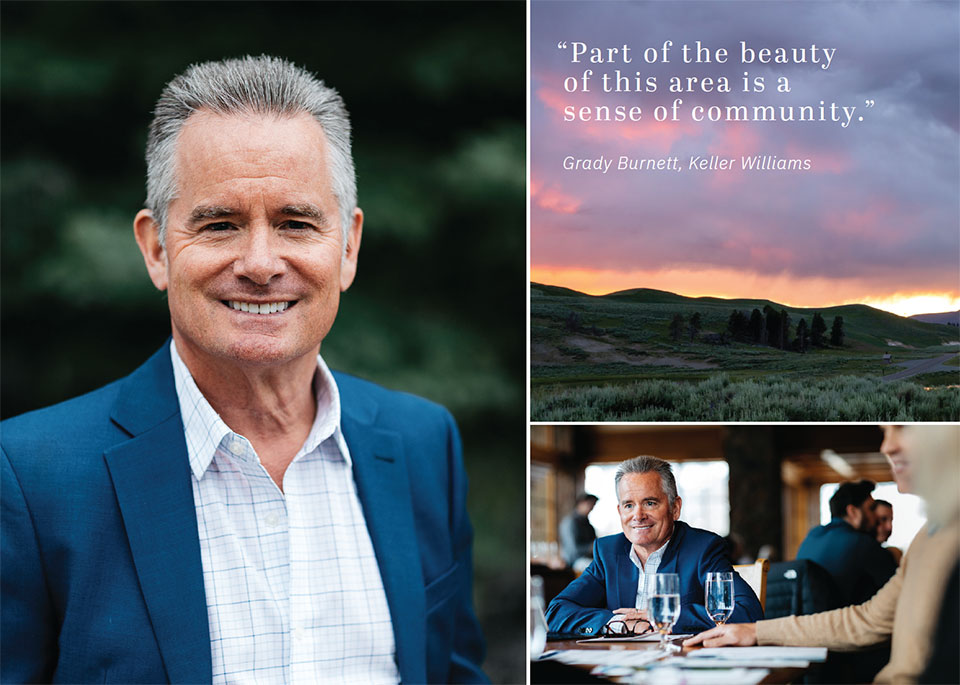

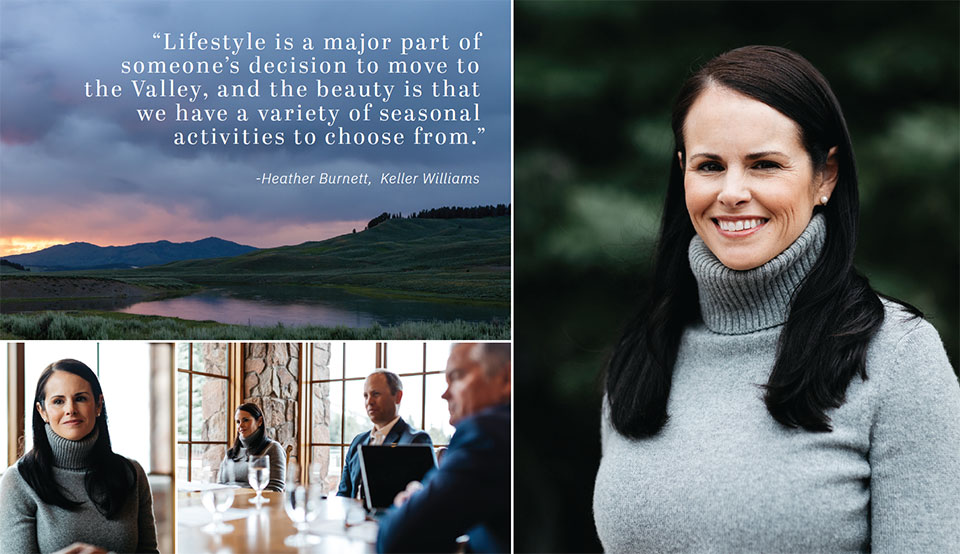

To make sense of these exciting times in real estate, Western Home Journal invited Grady and Heather Burnett of Keller Williams, Randy Flood of Windermere Real Estate, Sue Engelmann of Berkshire Hathaway, and Aaron Hill of Keller Williams to offer experience, opinions, and observations on what is happening in the current real estate market and why Sun Valley is still the best in mountain town living.

whj : What is the state of the Sun Valley real estate market for 2023?

Grady Burnett: The Sun Valley market is stable. Over the last several years, we’ve seen unprecedented demand. Demand remains solid but calmer and more consistent than in 2020 and 2021. Buyers now have more negotiating power, but we’re telling sellers they can still get a premium for their homes if they price them correctly from the start. Prices have increased in many areas, and sellers can realize significant values if they market their properties appropriately. But if a seller wants to remain in the Valley, they should plan on paying a premium for their next property.

Aaron Hill: I started working in this market in the fall of 2020, and the COVID migration was widespread. Agents put multiple properties under contract every month until the summer of 2022, when the market nearly stopped. At the higher price points last July and August, there was only one sale over four million dollars. Then the media announced that home prices would decrease by 25% last fall. There was uncertainty in the market, and buyers were waiting for this to happen. However, this did not come to fruition. In the first quarter of 2023, the price correction has been negligible, and people who want to transact in this area know there’s minimal inventory. To transact, buyers have to meet sellers where they’re at, which is still at historically high pricing. That said, transaction volume has slowed considerably as there are fewer buyers who are willing to step up on pricing.

Randy Flood: What has changed in our valley over the last 40 years? In 1982, it was hard to make an income.

Sue Engelmann: Minimum wage was $3 an hour.

RF: Houses were $40,000, and you made $24,000 yearly. Interest rates were roughly 18%. What structurally has changed in our marketplace is a look back at the Great Recession, when we lost Smith Optics and white-collar economic jobs because of the difficulty of getting to our marketplace. What has changed in 2023 are situations like the imploding San Francisco office building market. What was a $100 million building then is now $30 million. This whole debt shift is going on because of the office markets in the cities, which have spread out all of the jobs that came to our valley. People can work remotely from Sun Valley. Technology allowed the spread of employment.

Heather Burnett: We haven’t seen a lot of new residents returning to the places they came from, and I think it’s because of the lifestyle they can enjoy here. Many buyers have settled in and are thriving—they’re not looking to return to urban markets.

Sue Engelmann: I think many stragglers still wanted to buy before COVID hit and maybe took a couple of shots at places during COVID when it was crazy, but they are still without a house. They watched this whole cycle, and they are still committed. We are all wanting to know what is going to happen. We will have an increase in inventory, although it might be slight. I am working with sellers—trustees, children, aging owners, and those with health issues who need to sell. These are homes that will be coming on the market that may not be brand-new mountain contemporary but are for sale. In many cases, it will be more traditional products. For buyers, there is product coming.

HB: There is still heavy demand for Sun Valley real estate. Many people are trying to make Sun Valley their permanent home.

AH: I have buyers who put land under contract and want to build in 2024. If you talk to builders, some are acting like it’s spring 2022 and will not build for under $1,000 to $1,500 a foot, but other builders who are booked this year do not have full bookings for 2024, which I think will create some downward pressure on building costs.

SE: I have a few buyers who are not building because there is too much uncertainty, and they may or may not hang on to their lot. They may have plans that are approved or are close to approval but will buy existing homes.

AH: Most of the land that has come onto the market for sale in the last four or five months comes with plans. Those are the same sellers pricing out their projects when construction costs were through the roof. What they thought they could do for $750, $800, or $900 a foot is more like $1,200 plus. The pendulum is about to shift. The cost of labor in this valley will not change or go down, which is one of the most significant talking points, but there are also other factors to consider in total construction costs.

SE: Some builders now have availability. I think there is a little lag where people think builders are so slammed that you cannot find a builder or architect. You can.

GB: Heather and I have summarized the 2023 market as returning to a more stabilized one. To some degree, we’re back to a regular Sun Valley real estate market.

SE: Yes, if you look at 2018 and 2019.

GB: We had a remarkable 2020, 2021, and the first quarter of 2022. None of us could have predicted what that would be like, given the shutting down of Baldy and the country in March 2020 and wondering what it all meant for real estate in the Wood River Valley. As things started to open up again, the phones began to ring, and they didn’t stop for nearly two years. People were coming to Sun Valley in droves, and it led to a record-setting $1.2 billion in 2020 sales and the same number in 2021. We rarely used to sell much real estate from January to March, but the first two quarters of 2021 and 2022 were some of the most significant numbers we have ever had in a winter season. Transactions have slowed in the first half of 2023, but I think there will be a busy real estate market this summer with new listings, strong demand, and limited inventory. Yet, the market fundamentals are still in play. Prices will remain high because we are still lacking inventory.

RF: If you think of places like Japan or San Francisco, the inventory for sale is minimal. Similarly, little is available if you search for a house in Hailey for under $800,000. The luxury resort real estate market above $5 million is slightly different. Those with disposable income are looking for something specific and don’t need a house immediately because it might be their third home purchase.

whj : Are buyers still purchasing with cash?

AH: There are still many cash buyers, especially at price points over $2 million.

HB: Yes, we’re seeing a lot of cash deals, as well. I’d like to elaborate on what Aaron just said. In the higher price range, we still see cash buyers. However, he’s right that sales under $2 million are generally financed deals.

SE: There’s a great deal of cash out there.

RF: Idaho is an excellent place for estate planning purposes. California is discussing taxing your 3% on real estate that hasn’t been sold for capital gains. There’s a lot of capital flight out of these markets because of fear from the estate planning standpoint, and the estate tax is in Oregon too. For estate planning, the $30 or $40 million net worth individuals are trying to do some estate planning by relocating. This is why Jackson Hole and Colorado have done so well. It seems like there is a great deal of cash out there, and the stock market is making people feel very wealthy. Until the stock market has a huge reset, we will continue to see a significant drive and demand in the luxury market.

SE: I talked to an agent in Jackson Hole who said they were killing it in the $20 million and over market, and nothing is happening at $2 million. The $1 to 4, 5, or 6 million in Sun Valley is our strength.

HB: Jackson Hole has different buyers. Sun Valley has traditionally lacked the cohort of ultra-wealthy international buyers that you see in places like Aspen, Park City, and Jackson Hole, and this has been a factor in the amount of buyers looking for $15-20 million homes.

RF: The high-end market in Sun Valley is quieter money versus Aspen. It’s been said that we’re seven years behind Aspen. In Aspen, a broker listed a quarter of an acre next to a ski hill for $24 million, and in Sun Valley, for a quarter of the price, you can have 205 acres with a 4,800-square-foot custom home with incredible views.

GB: That was eye-opening and a great marketing message to put out.

SE: We all have to mine for unlisted properties, and the NAR’s (National Association of REALTORS®) clear cooperation policies are getting in the way of some of that communication.

GB: We are treading very carefully, especially for sellers with second-home luxury properties that they don’t want to list publicly on the MLS. We used to call these ‘pocket listings,’ which have significant limitations.

SE: NAR’s clear cooperation policy states that if it’s not listed on the MLS, we cannot market. Thus, we have an underground market, as sellers don’t want to publicize their prices and often availability. Finding a property to fit your client is part of real estate. We did not have to do that for the last three years. Clients found properties themselves, and we wrote them up. So it’s going back to the basics.

AH: The last few years were a very reactionary market, and any agent could do well. If you look at the market now, you must be very proactive, understanding the specific wants and needs of a client or a few clients and finding that, and coming back to them to tell them why this is valuable to them in this market. It’s where you add value as an agent. Then, it’s going out there to find the deal.

whj : What is selling and what type of inventory exists?

AH: In my opinion, land is not selling. People are still scared of construction costs, and land prices are still high. What is selling is anything finished, nice, from $2 to $6 million, and new or newer.

RF: Properties that did not sell last summer are now moving. We had ten years’ land inventory before COVID, and now there’s almost nothing.

GB: Pre-pandemic, land was always slower to move than finished homes. However, once we sold out of the majority of the listing inventory in the summer of 2020, people turned to vacant land to build their dream houses. A land run started about a year and a half ago but has slowed as we’ve encountered a shortage of builders and contractors available to start on a project. It will be interesting to see what happens with land this summer. As inventory remains low, buyers may circle back to vacant land with the understanding that it might not be an immediate start to construction.

whj : Is a new home build still very desirable? What about remodels?

SE: Some of the best real estate traded in the ‘60s, ‘70s, and ‘80s. Most of these prime lots are occupied by dated homes. So, you either buy it and remodel or take it down.

AH: Remodels are very attractive right now. Buying a 1990s home that needs updating, especially if it has good bones structurally, is very popular. Many people are doing this. Unfortunately, in our market, many ‘80s and ‘90s houses cannot be fixed to satisfy today’s buyer. Sellers still want more for these homes than the lot value, in which case it will sit on the market.

RF: The most available undeveloped lots in the Valley are in Elkhorn. In Ketchum, there are few available.

SE: Our market needs to be more consistent.

whj : Where is the high-end market going?

AH: We are a bargain compared to other resort markets that have not been voted Best Ski Resort for three years. So I think when we look back in five to ten years, we will see today as a buyer’s market.

GB: Sun Valley is a household name more than ever because of the lifestyle you can enjoy here. We’ve helped a handful of buyers relocate from other resort towns because they are searching for a more intimate community that offers the best recreation without the crowds and traffic. In that regard, we believe the demand for high-end homes will be robust as this community has been discovered!

AH: What is interesting is that in the past, you would come to Sun Valley because your grandparents came here or your best friends had a house here, and there was a reason to visit. In the last few years, we’ve seen so many people move here after visiting several other resort areas. I have had clients call me and tell me they are going to Telluride, Park City, Deer Valley, and Jackson Hole. Don’t waste time with me. We are looking at all the ski towns. Then, they called two months later and said they picked Sun Valley.

RF: We went to ski races in Park City, and you must reserve a parking pass a week in advance. It takes 45 minutes to get out of the parking lot, and the eight-mile commute to Kimball Junction can take hours. However, unlike Sun Valley, it is a mountain town next to a significant city.

whj : How does the Sun Valley lifestyle attract buyers?

GB: Unlike other resort towns, the Wood River Valley is a true community, and this is something we always talk about with new buyers. We are not a suburban ski town outside a massive city like Vail or Park City. Part of the beauty of this area is a sense of community. When there is a hardship—think of the wildfires in recent years—residents come together and support each other. There is a sense of unity within the community, and it’s widespread to all be at the same parties and gatherings. We’ve been fortunate to keep a sense of humility.

RF: At the Pioneer Saloon in Ketchum, you can have a billionaire and a sheetrock guy sitting side-by-side, and that’s nothing new. But in the 1980s, our community was more fragmented. You had the Ketchum and Sun Valley community and then Hailey, but now with sports like ice hockey and lacrosse, the community of kids is more integrated than ever.

AH: The early COVID transplants were forward-thinking business leaders trying to find a better path for their families. They are not the status quo type of people. When you put many people like that in a community, they solve problems and create opportunities for others once they get together. They want to be part of the solution. Sun Valley Lacrosse is a good example. The support for that program has grown in the last three years, fueled by the energy of new folks in this town.

HB: Lifestyle is a major part of someone’s decision to move to the Valley, and the beauty is that we have a variety of seasonal activities to choose from. I think people move to the Valley because they want an active lifestyle surrounded by year-round beauty. Yes, we’re known for winter days skiing on Baldy, but the summer is chock full of activities, including pickleball, hiking, golf, and fun days at Redfish Lake.

whj : What types of homes are trending in the Wood River Valley?

HB: Many out-of-state architects have brought a level of sophistication to home design, but there’s still an element of simplicity. They are upping the game on systems, but there’s always beauty in clean finishes. Mountain modern is still on trend, but it’s also fun to see a return to traditional, timeless finishes.

GB: People coming to Sun Valley and building new homes seek high-quality custom builds.

AH: One of the significant trends I have seen is that many people are activating every piece of their property, doing cool stuff with outdoor kitchens, numerous seating areas with an eye towards sun/shade, landscaping with firepits, and using local products.

RF: We are selling the 1970s condo. We need to convert that product to make it worthwhile.

GB: Homes that have been well maintained, even if they’re older, are great. But you must keep up with improvements—replacing windows, roofs, siding, and landscaping—if you want to compete with newer homes.

HB: New homes and recently remodeled homes are very desirable. With builders and tradespeople still being busy, most buyers want a primary residence that is move-in ready. If it’s a vacation home, buyers are also looking for a turnkey, fully furnished property. The ease of transition is key for most buyers.

whj : Where will the high-end (over $5 million) property be in a few years?

SE: It’s interesting. We had several high rollers in over the holidays who were looking. There was definitely showing action. Some are now thinking 1-to-2-month high end rentals as a way to test drive. We had a run of high-end sales in March of 2022. Currently we have a few in this range pending so there are folks jumping in. When you get up to the price point, it is all about construction, and many are beautiful but older legacy properties. There’s work to be done, and not all Buyers are up for the task and prefer new, newer, and furnished. That said, we have a few properties both on and coming to market that are irreplaceable. The existing improvements can be removed or remodeled. Location is key.

RF: It is interesting to see these trends and the downsizing of a house. We did a transaction in September, and this woman built a home where she didn’t want guests. She just wanted two bedrooms.

SE: Other sellers are those who have too many homes to care for and want a better quality of life besides living to maintain them.

AH: I see demand for high-end rentals. Couples are traveling more together. Sun Valley bookings were up seven percent this year. So a certain percentage of that is people interested in rentals.

RF: Our uniqueness in what we have is the Holding family, who put their heart and soul into the mountain and continue to make improvements. The Ikon and Epic Passes have also changed things regarding bringing people to ski in Sun Valley.

AH: The airport’s size is unique and small, keeping Sun Valley special. A bigger airport would change the Valley.

whj : What are some predictions for the Sun Valley real estate market?

RF: From a traffic perspective, the traffic was worse in the 1990s coming up to Ketchum than it is now. The road expansion has made it better. All the sales between Hailey and Bellevue might make Bellevue a prediction in the next ten years with its thriving economy.

HB: The growth we’ve experienced over the last two-plus years is exciting. Yes, the landscape has changed, but we’re seeing many beautiful new homes enhancing the area. This is an incredible valley, and the recent additions raise the bar. I suspect this summer will be busy as new inventory hits the market. The key, however, will be pricing. Time will tell.

RF: Growth and sustainable growth are good.

HB: It’s good to have young people around, and we are selling to more families than ever before. The vitality these families bring will make this community hum for a long time, which feels great.

SE: On the inventory front, having more choices is one of the things that helps make a buyer buy. When you have more for people to choose from, they have options. So inventory expansion will benefit us.

AH: We are so lucky to work where we are proud to sell what we have created in this community and the opportunities for kids, and the access to the outdoors. I drink the Kool-Aid every day. It’s amazing.

SE: It’s not just a ski town. We have an amazing cultural community here that fits with the wealth and intelligence that comes in. So once they understand that, and how much goes on here and how much philanthropy exists, it’s another huge upside for and to the community.