The statistics are ever-changing when trying to rank the best ski resorts in the nation and the categories are myriad. Which resorts get the best snow? Which have the most intriguing nightlife? Best vertical? Least traffic? Unbeatable après? Year after year, a different factor is thrown into the mix and adjusts the rankings once again. It seems to be virtually impossible to get stable rankings with all of these factors under consideration, but RealtyTrac has attempted just that in its quest to find the best ski resort towns for real estate investing.

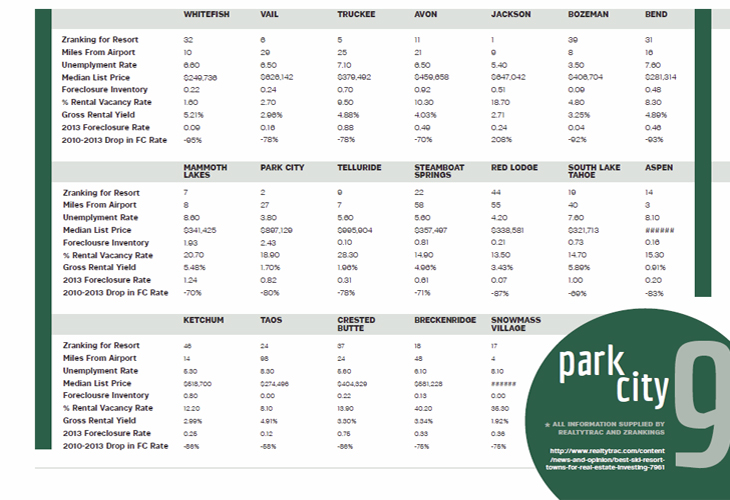

RealtyTrac’s methodology? Hire Zrankings to supply them with the 50 highest-ranking resorts based on “pure awesomeness” (which, we admit smacks of subjectivity), then further whittle it down by only listing the resorts with over 2,500 full-time residents, thus leaving 19 resort towns to choose from. Then RealtyTrac added in eight reliable factors (real numbers), and combined the results for the overall ranking, with Park City coming in at #9. But what RealtyTrac didn’t consider (because they ran these factors before the big announcement) was Vail Resort’s recent acquisition of Park City Mountain Resort. With the announcement, real estate activity in Park City spiked and all market watchers agree, the news will mean big things for Park City’s real estate market. In other words, it’s epic in Park City.

1. PURE AWESOMENESS FACTOR

From Zrankings, this puts a number on the quality of the ski resort in the town..

2. DISTANCE FROM THE AIRPORT

The property should be easy to get to, both for second-home

owners and other vacationers who help drive the local economy.

3. UNEMPLOYMENT RATE

More people with jobs means more renters and future buyers if you want to sell.

4. MEDIAN LIST PRICE

All other things being more or less equal—the lower the price, the better. Investors make their money when they buy low.

5. FORECLOSURE INVENTORY

This inventory is actually good for the investor as it means more bargains available.

6. RENTAL VACANCY RATE

A low vacancy rate means strong demand for your home as a regular or vacation rental.

7. GROSS RENTAL YIELD

The higher the gross yield, the better chance to cover or exceed your costs of owning a home.

8. 2013 FORECLOSURE RATE

Although foreclosure inventory is good for bargains, too much recent foreclosure activity could be bad for home values.

9. FORECLOSURE RATE DROP FROM 2010

The bigger the drop from the height of the housing crisis, the faster the market is recovering.